after tax income calculator iowa

Using the annual income formula the calculation would be. Your average tax rate is 217 and your marginal tax rate is 360.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Optional Choose Normal View.

. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. For instance an increase of. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. However for those who make. Our Income Tax And Paycheck Calculator Can Help You Understand Your Take Home Pay.

The following steps allow you to calculate your salary after tax in Iowa after deducting Medicare Social Security Federal Income Tax and Iowa State Income tax. United States Italy France Spain United Kingdom Poland Czech Republic Hungary. With five working days in a week this means that you are working 40 hours per week.

The federal income tax has seven tax brackets which range from 10 to 37. The above calculator assumes you are not married and you have no dependants so the standard. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

For individuals who make more than that the Iowa income tax rate will be 68. Iowa Income Tax Calculator 2021 If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. If you make 20000 in Iowa what will your paycheck after tax be.

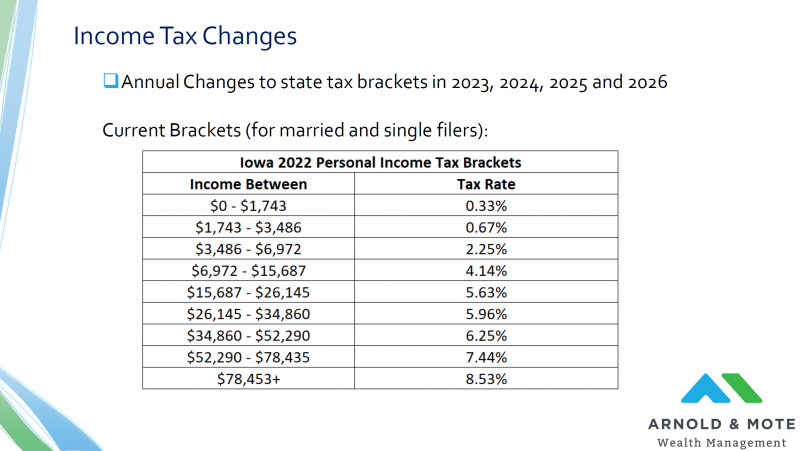

Iowa Income Tax Calculator 2021 If you make 170000 a year living in the region of Iowa USA you will be taxed 46128. Individuals earning less than 1743 per year will face a flat tax rate in 2022. If you make 70000 a year living in the region of iowa usa you will be taxed.

Annual Income 15hour x 40 hoursweek x. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Calculate your net income after taxes in Iowa.

Your average tax rate is 1871 and your marginal tax rate is 24. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. See What Credits and Deductions Apply to You.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Compound Interest Calculator Present. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Ad Enter Your Tax Information. That means that your net pay will be 43543 per year or 3629 per month. Your average tax rate is 1198 and your marginal tax rate is 22.

Discover Helpful Information And Resources On Taxes From AARP.

How Is Tax Liability Calculated Common Tax Questions Answered

Iowa Paycheck Calculator Smartasset

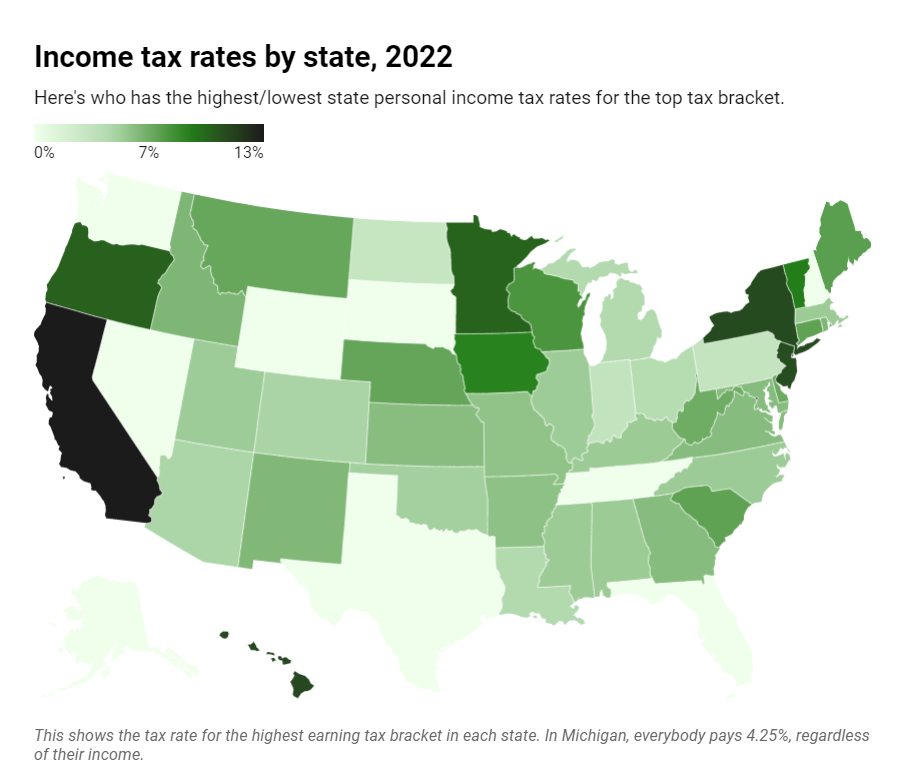

How Do State And Local Individual Income Taxes Work Tax Policy Center

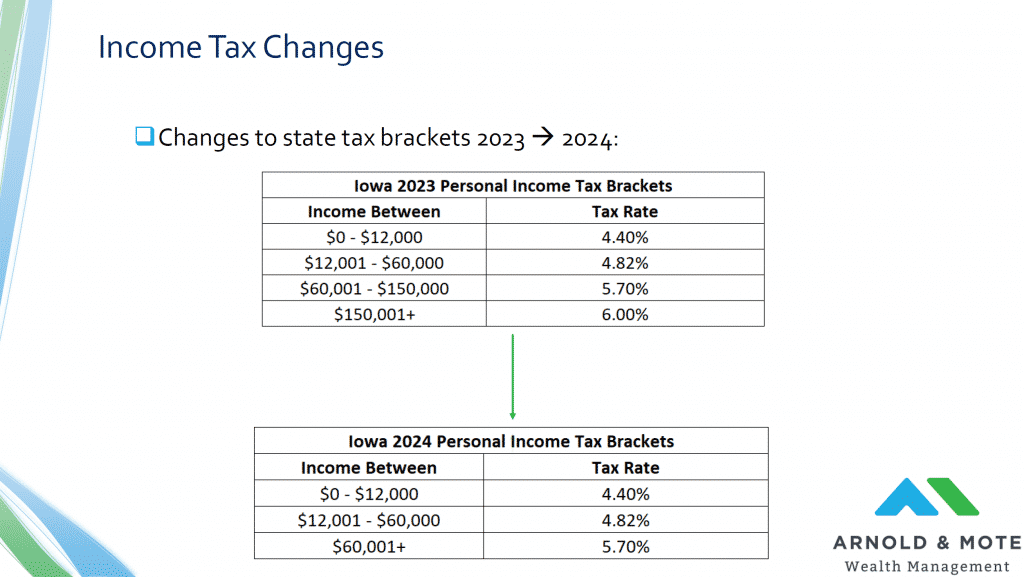

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Georgia Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

You May Not Want To Hear How Much Money You Have To Make To Live In Northern California Map Usa Map 30 Year Mortgage

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Understanding Progressive Tax Rates Ag Decision Maker

In Iowa Your Taxes Help Corporations Not Pay Theirs Caffeinated Thoughts Tax Help Tax Forms Business Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Calculator 2021 2022 Estimate Return Refund

2022 Federal State Payroll Tax Rates For Employers

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)